DETAILED CASE STUDY

Dropshipping in India — 90 Day Growth Journey

From uncertainty to clarity: how disciplined testing, video-first creatives, and tight delivery processes transformed performance into a repeatable growth system.

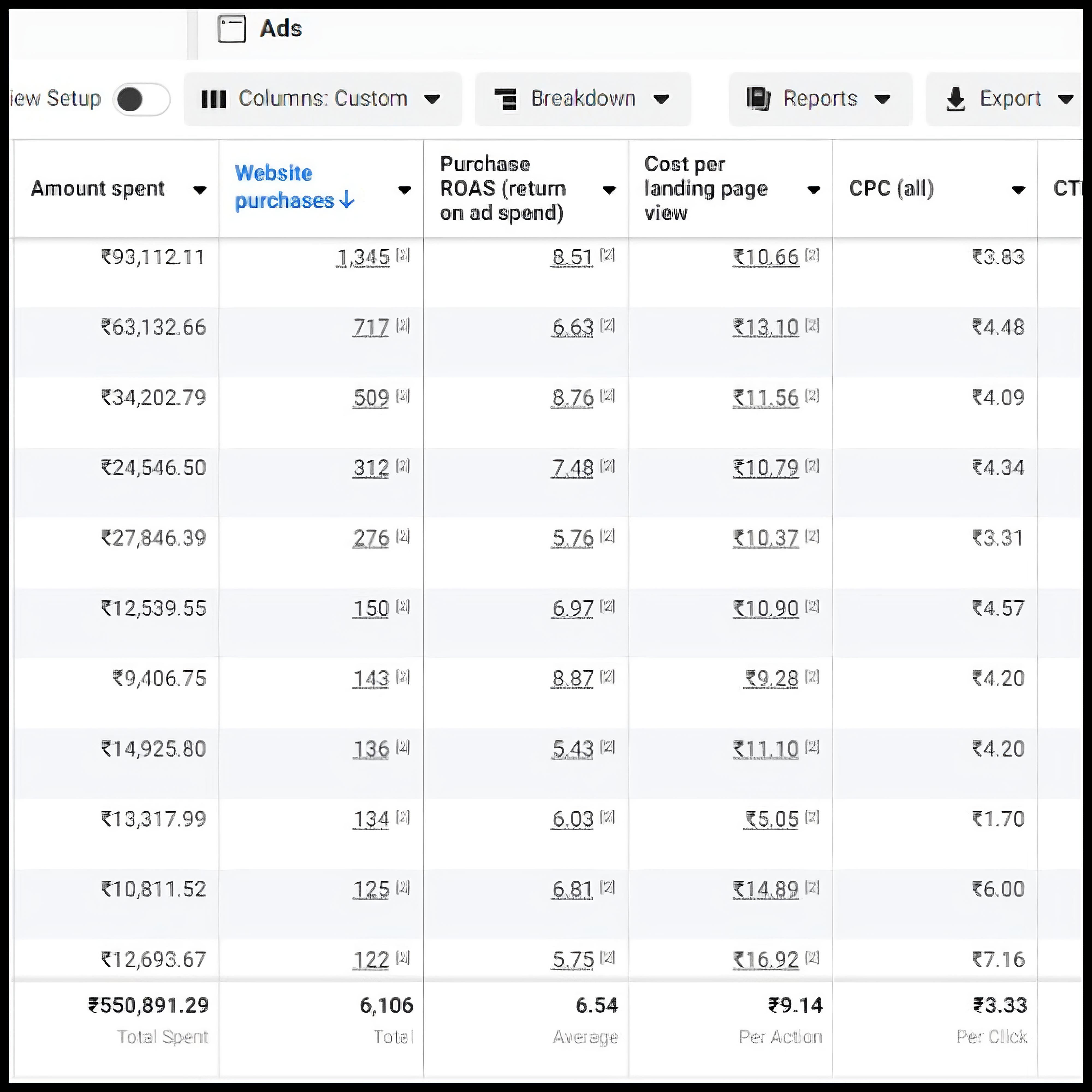

₹26,07,739 in Revenue with 6.54× ROAS — Dropshipping in India (90 Days)

Turning a messy testing phase into a predictable growth system using video-first creatives, tight feedback loops, and disciplined scaling—while keeping profitability intact.

- Industry Dropshipping

- Market India

- Platform Shopify + Meta Ads

- Period 90 Days

Revenue

0

Ad Spend

0

Average ROAS

0

Orders

0

Context & Objective

The brand was in the classic dropshipping “search mode”: frequent product failures, rising costs, and no clear creative direction. Our goal was simple—find winners fast, prove profitability, then scale without breaking cash flow or customer experience.

Key Challenges

- Multiple product failures during the first tests.

- 20–30 products tried before identifying 2 solid winners.

- Dozens of creatives tested — image ads underperformed, videos worked better.

- High RTO (failed deliveries) hurting margins and cash flow.

Strategy — What We Did

1) Product Pipeline & Testing

- Lightweight scoring sheet (demand, margin, delivery readiness).

- Rapid A/Bs with small budgets (ABO) to avoid overcommitting.

- Clear kill rules (24–48h) → scale rules when MER/ROAS targets hit.

2) Creative Lab (Video-First)

- Shift from static images to UGC-style videos (hook → problem → demo → proof → CTA).

- 3–5 hooks per product, reused best endings to speed production.

- Weekly creative retro: thumb-stop, hold rate, CPC, CPA → brief next batch.

3) Account Structure

- Testing: ABO, broad + stacked interests, 3–5 creatives/ad set.

- Scaling: CBO with the best 1–2 products and top creatives.

- Retargeting: warm buckets by depth (VC/ATC/IC – 7/14/30d).

4) Delivery & RTO Control

- Stricter COD confirmations + address verification on checkout.

- Clear ETA on PDP + WhatsApp/SMS nudges post-order.

- Courier rules for risky zones to reduce returns.

5) Measurement & Guardrails

- Watched both Ad ROAS and blended MER to avoid channel bias.

- Daily cash-flow check: spend pacing vs. pay-cycle for smooth scaling.

- LP QA: speed, trust markers, and policy compliance.

Execution Timeline (12 Weeks)

- Weeks 1–2: Baseline install, pixel/events check, fast creative seeding.

- Weeks 3–4: Winners emerge → consolidate budgets, cut underperformers.

- Weeks 5–8: Scale on CBO, expand hooks/angles, start warm retargeting.

- Weeks 9–12: Stabilize CAC, harden delivery ops, and lift AOV with bundles.

Results

- 0 total revenue in 90 days.

- 0 ad spend with disciplined scaling.

- 0 average ROAS maintained.

- 0 purchases attributed in-platform (Meta).

- Video creatives consistently beat image ads on CTR, CPC, and CPA.

- RTO reduced through better confirmations and clearer delivery expectations.

Want a similar outcome for your store?

Let’s audit your product, creative, and delivery stack—and map a 30-day plan.

Book a Free Growth Call